Long-Term Wealth Development Via Realty: A Smart Investment Strategy

Property has actually long been considered one of the most effective cars for long-lasting wide range creation. Unlike temporary investments that focus on fast gains, realty supplies consistent cash flow, property admiration, and tax benefits that can considerably expand your net worth in time. Whether you're a brand-new investor or an experienced one looking to increase your profile, comprehending the fundamentals of long-term real estate investing can set you on the course to economic liberty.

Why Realty is Ideal for Long-Term Wealth Production

Recognition and Value Development

Gradually, real estate homes tend to value in worth, permitting financiers to construct equity. While market changes may take place, historically, real estate worths raise over the long term.

Easy Revenue from Rentals

Buying rental properties gives a constant revenue stream. Well-kept properties in high-demand locations can create positive capital, covering mortgage settlements and expenses while giving additional revenue.

Utilize and Wealth Building

Unlike other financial investments, property allows capitalists to make use of take advantage of, meaning you can acquire residential properties with a fraction of the cost upfront ( via mortgages), making use of other people's money to construct wealth.

Tax Benefits

Real estate investors can take advantage of tax reductions, consisting of mortgage rate of interest, building depreciation, repair work, and upkeep, lowering their taxable income and maximizing earnings.

Inflation Hedge

Realty is a concrete property that typically keeps pace with inflation. As home values and rental earnings increase, financiers can secure their acquiring power and keep stable returns.

Finest Strategies for Long-Term Riches Development in Realty

1. Get and Hold Method

This method includes buying residential properties and keeping them for an extensive duration, gaining from admiration, rental revenue, and tax obligation advantages.

Suitable home types: Single-family homes, multi-family devices, and commercial property in expanding markets.

2. Purchasing Rental Qualities

Concentrate on obtaining residential or commercial properties in high-demand areas with strong work development, outstanding schools, and low crime prices.

Take into consideration residential property administration services to enhance operations and reduce stress and anxiety.

3. Residence Hacking

Reside in one unit of a multi-family property while renting the others to balance out mortgage prices.

A terrific way for new financiers to enter the property market with very little economic danger.

4. Real Estate Syndications & REITs

For those aiming to invest passively, property investment trusts (REITs) or syndications enable investors to merge funds for massive projects without straight management duties.

5. BRRRR Method ( Acquire, Rehab, Rental Fee, Refinance, Repeat).

This technique entails purchasing underestimated residential or commercial properties, restoring them, renting them out, re-financing based on the brand-new worth, and utilizing the profits to invest in additional residential properties.

Calls for careful planning and economic discipline to carry out effectively.

Typical Blunders to Avoid in Long-Term Realty Spending.

Overleveraging-- Taking on too much debt can bring about economic pressure throughout market declines.

Ignoring Market Research-- Investing without assessing the local market trends, task development, and need can lead to bad home performance.

Taking Too Lightly Expenses-- Unexpected fixings, jobs, and maintenance costs can impact capital.

Stopping working to Diversify-- Relying upon a single building kind or market can increase financial investment risk.

Avoiding Due Diligence-- Carrying out thorough residential property evaluations, validating financials, and understanding regional regulations are important actions before buying.

Long-term riches production with realty calls for persistence, calculated planning, and continuous market awareness. By leveraging appreciation, rental income, tax benefits, and rising cost of living resistance, property investing can give economic security and generational wealth. Whether you're buying rental properties, residence hacking, or buying REITs, complying with tested strategies and staying clear of usual risks will place you on the course to lasting monetary success.

Are you ready to begin developing long-term wealth Green Springs Capital Group through real estate? Take the very first step today and protect your monetary future with smart property financial investments!

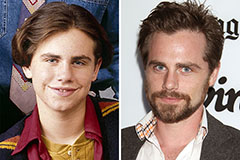

Rider Strong Then & Now!

Rider Strong Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!